IPO-bound cloud kitchen major Curefoods’ net loss remained almost flat at INR 169.9 Cr in the year ended March 2025 (FY25) as against INR 172.6 Cr in the previous fiscal year.

The loss saw only a marginal decline despite a healthy rise in the company’s top line. Curefoods reported an operating revenue of INR 745.8 Cr in FY25, up 27.4% from INR 585.1 Cr in the previous fiscal year, as per its DRHP filed with SEBI.

Curefoods, which owns brands like EatFit and CakeZone, is looking to raise up to INR 800 Cr through a fresh issue in its IPO. Besides, the public issue will comprise The IPO will comprise an OFS of up to 4.85 Cr equity shares.

As part of the OFS, investors Iron Pillar PCC, Crimson Winter, Accel India V (Mauritius), Chiratae Ventures India Fund IV, among others, will pare their stakes.

Founded in 2020 by former Flipkart executive Ankit Nagori, Curefoods operates multiple brands under a cloud kitchen model. It generates revenue primarily from sale of food items, supplemented by kiosks and physical restaurants.

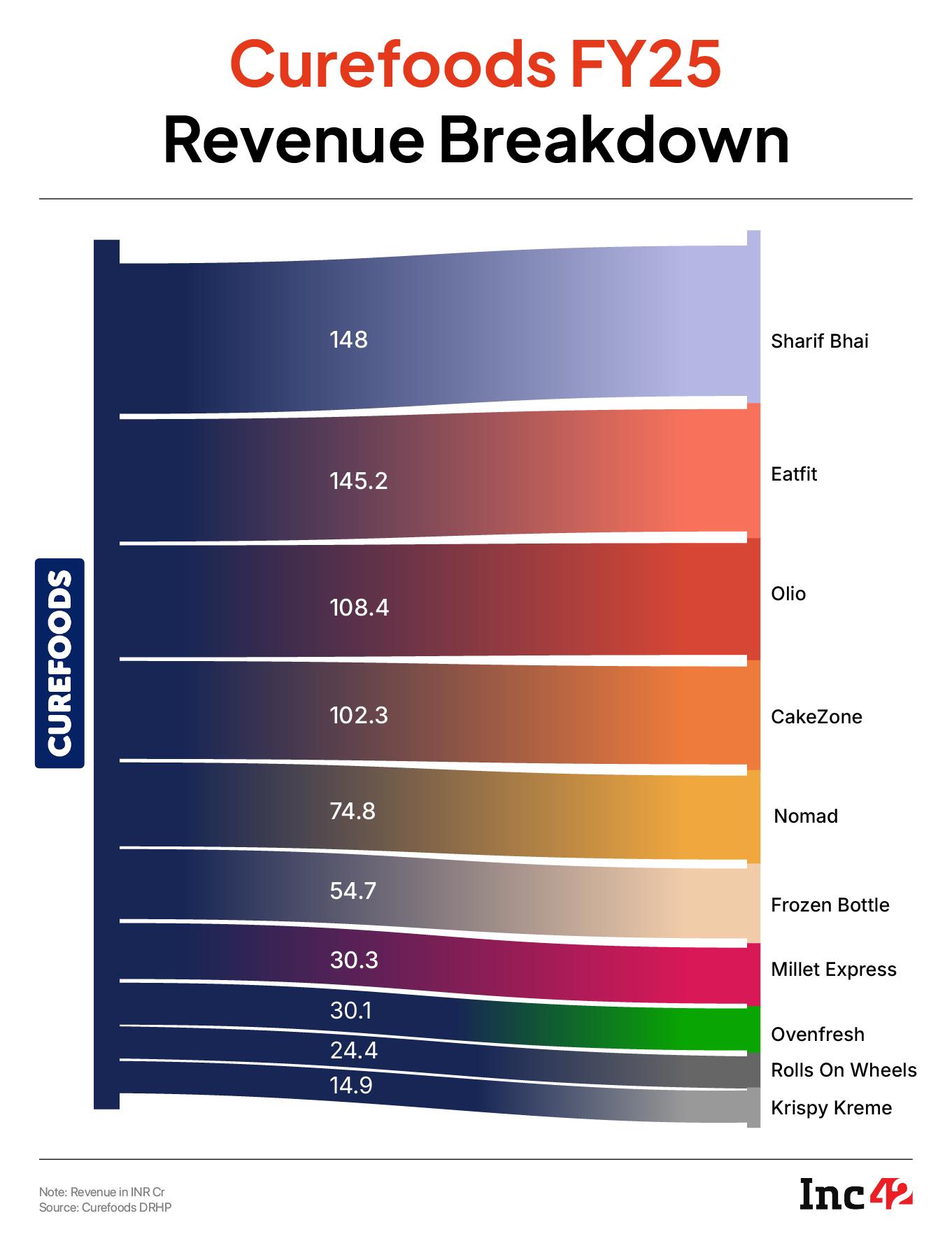

Curefoods’ House Of BrandsThe company’s revenue from operations primarily includes direct sale of food items, service income (such as franchise fees and royalties), and other minor operating income. In FY25, Curefoods earned INR 740.9 Cr from sale of food items and about INR 3.45 Cr as service income (likely from its franchised operations).

Over the years, Curefoods has aggressively expanded through acquisitions and brand partnerships, building a portfolio of over 25 brands.

Some brands like Krispy Kreme, Sharief Bhai, Frozen Bottle, and Ovenfresh were integrated through business transfer agreements or franchise deals.

What stands out is that Curefoods has adopted a “house of brands” approach, with intellectual property (IP) ownership or control through long-term franchise rights. For example, Krispy Kreme India was acquired from Citymax (Landmark Group) via a master franchise agreement with Krispy Kreme Doughnut Corporation. This gives Curefoods access to premium international branding while maintaining operational autonomy.

As the startup has a diverse and decentralised revenue structure, with no single brand dominating the portfolio, it allows Curefoods to mitigate risk from shifting consumer trends and enables agile repositioning of offerings in the market, the draft paper said.

Furthermore, geographic disaggregation shows that Curefoods derives nearly all revenue from the domestic market, with a minor foreign contribution of INR 5.9 Cr in FY25, likely linked to Sharief Bhai’s expansion in the UAE.

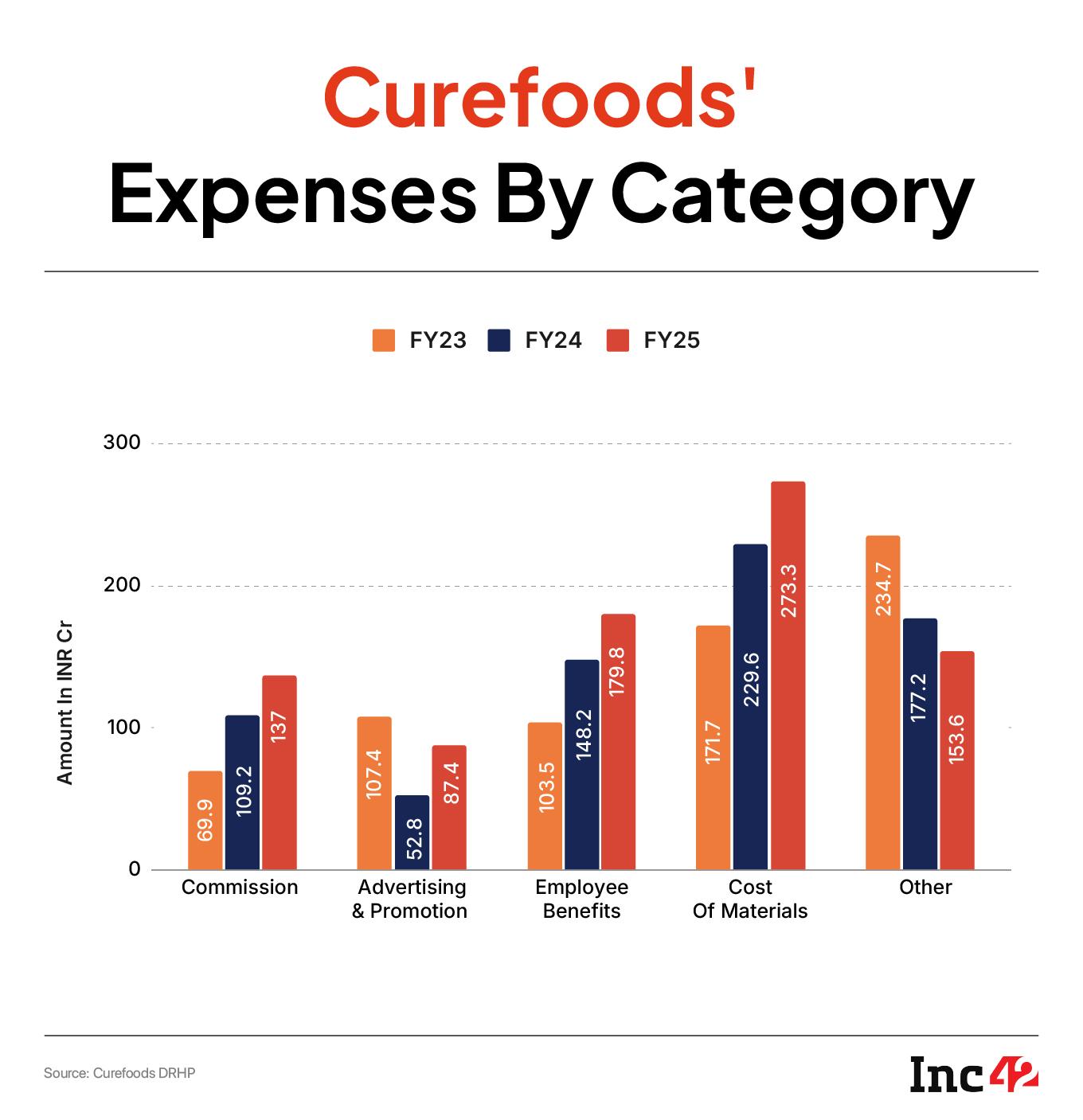

Where Did Curefoods Spend?The company’s total expenditure rose 17% to INR 944.2 Cr during the year under review from INR 806.9 Cr in FY24. Here’s a breakdown of the major expenses:

Commission Expenses: The spending under this head stood at INR 137 Cr in FY25, up 25.4% from INR 109.2 Cr in FY24.

Advertising & Promotion Costs: The expenses under this head surged 65.5% to INR 87.4 Cr in FY25 from INR 52.8 Cr in the previous fiscal year.

Employee Benefit Expenses: The company’s employee expenses rose 21.3% to INR 179.8 Cr in FY25 from INR 148.2 Cr in the previous year.

Cost Of Materials: The expenses under this head jumped 19% to INR 273.3 Cr from INR 229.6 Cr in previous fiscal.

The post IPO-Bound Curefoods’ FY25 Loss Almost Flat At INR 170 Cr appeared first on Inc42 Media.

You may also like

Wimbledon protocol broken with BBC commentator left in tears over emotional scenes

Perform duties as humble servants of Lord Jagannath: Odisha CM to officials

Backpacker's haunting final text before fatal volcano fall that left her trapped

NASA astronaut Anil Menon assigned mission to International Space Station

After India ban, Mawra Hocane's Instagram account reappears: Which Pakistani celebs are back online?