The frenzy over India’s startup IPOs could be back in fashion, but for several of the new entrants to the market last year, the honeymoon is already over. Like MobiKwik, which has been in a world of pain since the listing.

MobiKwik’s net loss increased over six times on a year-on-year basis to INR 41.9 Cr, from INR 6.6 Cr for the same quarter last year, while operating revenue declined 20.7% YoY to INR 271.3 Cr.

And yet, the story isn’t entirely one of decline. MobiKwik delivered its highest-ever payments gross margin and GMV growth during the quarter, signalling underlying strength in its core payments business. Sequentially, losses narrowed, contribution margins expanded, and unit economics improved — so is MobiKwik getting a handle on things or is it in for more pain?

Let’s find out, but after a look at the top stories from our newsroom this week:

- Is Opinion Trading Dead? Probo and other opinion trading apps surged during IPL 2024, letting users bet on real-world outcomes like sports and elections. These platforms now face legal heat, with ED raids and multiple state-level FIRs and PILs challenging their legality

- Google’s AI Push For Ads: Google is not just leveraging its YouTube and Search tools to scale massive ad revenues in India, but has also engaged brands, startups to solve their marketing pain points. So, how is Google AI wooing Indian brands?

- WeWork India’s IPO Googly: The WeWork IPO comes amid a coworking boom, but as a 100% offer for sale, there are concerns that this is largely an exit event for existing investors rather than a growth stock. Will IPO investors see any upside from this issue?

A large portion of this pressure originated from its financial services business, which was a main growth driver in the past, as revenue fell 65% from INR 170.7 Cr in Q1 FY25 to mere INR 58.3 Cr in Q1 FY26, reflecting a sharp deceleration in lending and credit-linked products.

Meanwhile, the cost structure of the company continues to be burdensome. Increasing platform transactional costs, higher expenses on lending expansion and financial guarantees, and ongoing fixed costs burdened the bottomline. Toss in greater expenditure on technology and product development, and the scenario looks bleak.

MobiKwik’s post-IPO experience has been one of declining financial services revenue on one hand, and enhancing operational rigor on the other. Whether the latter can facilitate the company in restoring investor sentiment in a market that has already penalised it harshly is the question.

The consolidated net loss of the company increased more than six times on a year-on-year basis to INR 41.9 Cr from a mere INR 6.6 Cr in Q1 FY25, although on a sequential basis losses decreased as against Q4 FY25’s INR 56 Cr.

The largest contributor was the firm’s financial services segment, which has traditionally been the main revenue machine.

The fall was a direct result of the suspension on disbursals through MobiKwik’s ZIP credit product, which had been the key driver of topline expansion in earlier quarters. While total payments GMV reached all-time highs, the pace didn’t catch up with revenue due to the fact that the payments business usually has thin margins as opposed to lending. The product mix change created a big hole that growth in GMV couldn’t possibly fill.

Lending Stress Hurts MobiKwikAnd if topline pressures weren’t sufficient, expenses associated with lending growth provided one more source of stress. Financial guarantee charges soared close to a tenfold increase to INR 21.3 Cr, compared to INR 2.5 Cr in the prior-year quarter.

This sudden spike is the result of MobiKwik’s expansion into higher-ticket, longer-horizon EMI loans, which are riskier. In order to protect lending partners, the firm has to give upfront guarantees, which places a disproportionate load compared to income. This cost spike not only narrowed margins but also skewed the firm’s risk-reward equilibrium in lending.

The third significant drag was payment gateway charges, which increased to INR 142.8 Cr from INR 127.6 Cr last year. As a percentage of total expenses, these fees represented close to half (47%).

As these expenses grow proportionally to the volume of transactions and not with profitability, the spurt in GMV actually pumped up costs without a corresponding boost in revenue or margins. What this emphasises is the built-in dhilemma in payments businesses: volume growth does not automatically translate to profitability growth.

Green Shoots Amid LossesOn the other hand, the company has moved to consolidate cost efficiency, expand its payments segment, and stabilize its lending arm — steps that suggest a more purposeful approach to taming its post-IPO woes.

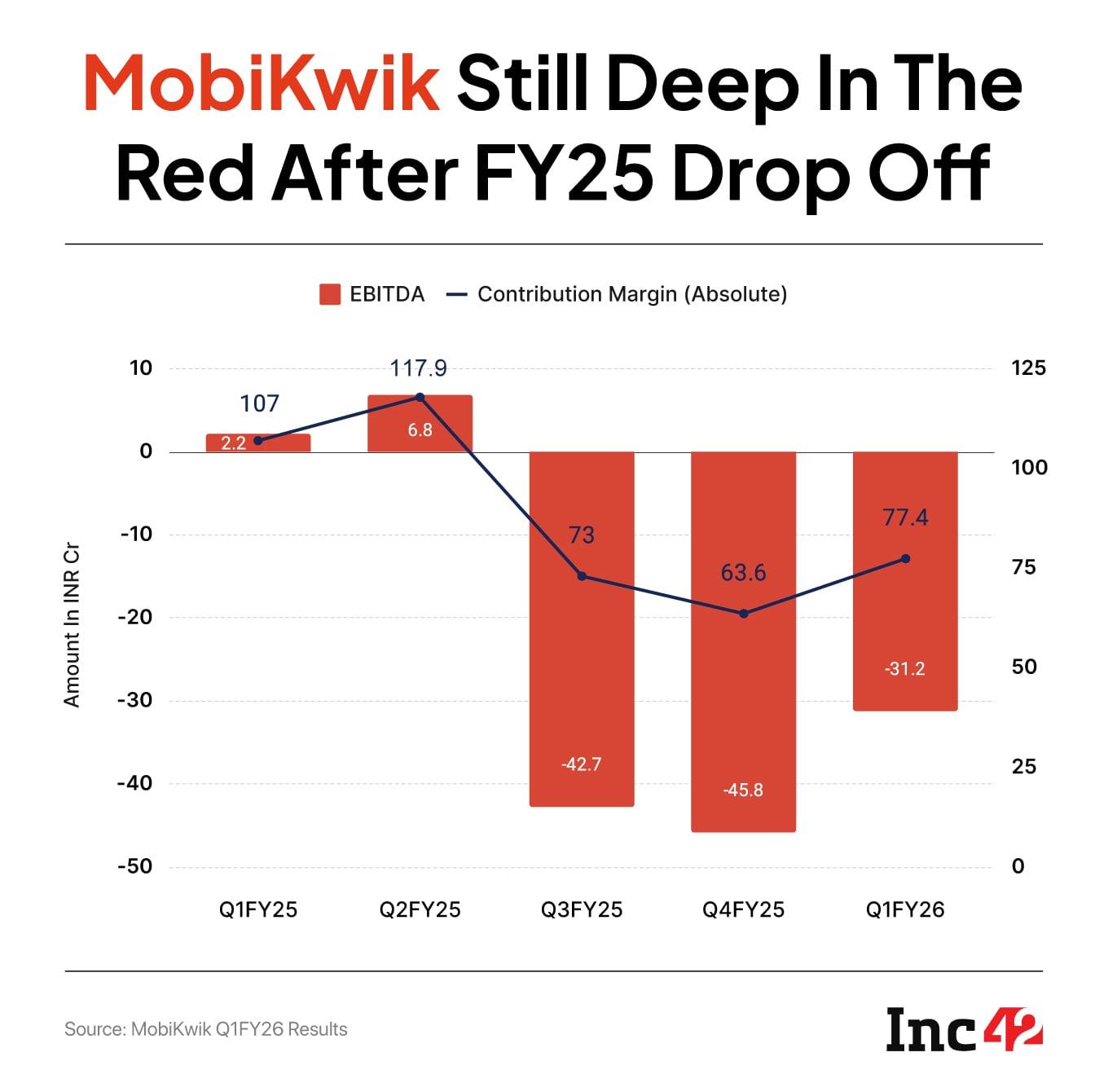

On the bottomline, sequential losses narrowed. Net loss was at INR 41.9 Cr against INR 56 Cr in Q4 FY25, improving 25% quarter-on-quarter. Likewise, EBITDA loss declined to INR 31.2 Cr from INR 45.8 Cr in the previous quarter, showing a 32% improvement.

Contribution margin also grew substantially, to 27.5% in Q1 FY26 from 22.8% in Q4 FY25 and merely 16.1% in the prior year corresponding period. Fixed costs increased modestly to about 39% of revenue with some resistance to inflationary pressures, highlighting improved cost control.

Another plus point: The reach of the platform continued to grow. MobiKwik onboarded 3.8 Mn new users in Q1, bringing its base to 180.2 Mn. In merchants, it onboarded 48.8K new partners, growing its base to 4.64 Mn.

MobiKwik’s Bet On Credit & BrokingThe payments business remains at the core of MobiKwik’s narrative, even as it is adding a chapter or two on diversification.

Payments alone generated over three-fourths of its overall revenue, emphasising their prominence in MobiKwik’s growth strategy. Margins have also hit all-time highs of 27.9%, as there were steep declines in payment gateway expenses and lower incentive outgo.

But the management is aware that payments alone cannot become the hallmark of MobiKwik’s future. With competition from players like PhonePe, Paytm and Google Pay, and the risks of regulatory overhauls, the firm has decided to construct a broader ecosystem where users can spend, borrow and invest in one go.

The boldest of these new bets is Pocket UPI, a wallet-based version of the traditional UPI that enables transactions without linking a bank account. As a less complicated and more secure alternative to India’s most popular payments instrument, Pocket UPI also has the potential to generate new monetization avenues if regulators enable PPI-on-UPI merchant discount rates in the future.

Credit is the other pillar, as we have heard in the past. MobiKwik has launched what it calls the First Card, an FD-backed RuPay credit card that guarantees 100% approval and free use for life.

Aimed at first-time credit users, the card is both a regular spending card as well as a credit builder for those in the informal credit economy. The company will be looking to upsell the card to users and take them from low-ticket wallet spends to higher-value credit products.

Finally, there’s stock broking — MobiKwik has received the approval of SEBI to become a registered broker, competing with the likes of Zerodha, Groww, Jio and others. MobiKwik is looking at the potential revenue upside from a complete full-stack digital financial platform where users pay bills, avail loans and invest in equities.

Such a step also generates annuity-like revenues in brokerage and advisory services, which makes MobiKwik immune from the fluctuations of payment and lending.

We also need to note that MobiKwik has a substantial war chest from its December 2024 IPO. Out of INR 5,305 Cr raised, over INR 3,100 Cr is lying untouched as of now, reserved for financial services expansion, payments infrastructure, R&D and devices.

Given this nest egg, the way forward for MobiKwik is straight: diversification. Payments will remain the driver of scale, but the true story of growth will be how well the company cross-sells its credit and wealth products, develops its B2B business, and develops broking.

Execution is always critical, but with Paytm’s turnaround in Q1, the pressure will be high on MobiKwik to show the same in the next quarter or two.

Sunday Roundup: Startup Funding, Deals & More

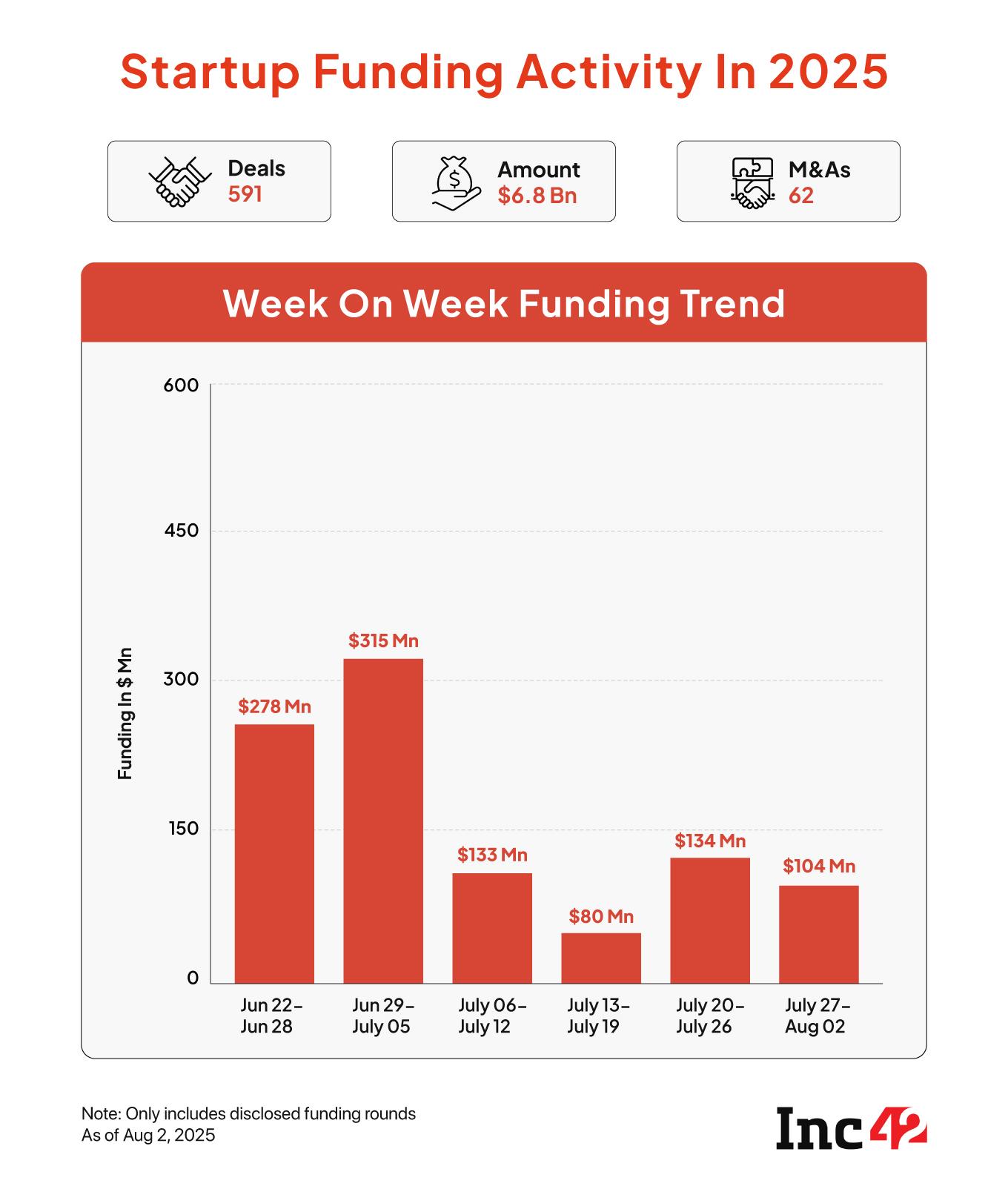

- Weekly Funding Drops: Between July 28 and August 2, Indian startups bagged $103.7 Mn across 14 deals, a 23% decline from the $134.4 Mn raised by 22 startups in the preceding week.

- B’luru Techie Held In CoinDCX Heist: Bengaluru police have arrested a software engineer at CoinDCX after hackers allegedly used his login credentials to exploit confidential financial processes. The accused has denied any involvement but admitted to engaging in moonlighting

- Jio’s $6 Bn IPO: Adding on to what seems to be a perennial discussion about Reliance Jio Infocomm’s IPO, Reliance Industries has initiated discussions with SEBI to sell a 5% stake in the telecom giant via an INR 52,465 Cr public listing

- Desi Farms Acquires Suruchi Dairy: The Pune-based D2C dairy brand has acquired the 28-year-old dairy company for about INR 130 Cr in an all-cash deal. While Desi Farms acquired a 51% stake in Suruchi Dairy in June, it will acquire the remaining 49% stake next month

- Astra Shuts Shop: Four months after raising capital from Perplexity founder Aravind Srinivas, the AI-focussed SaaS startup has shut down after disagreements between cofounders and rising competition. Astra offered an AI-powered sales analytics platform for businesses

The post MobiKwik On Shaky Grounds After Weak Q1 appeared first on Inc42 Media.

You may also like

Qatar boosts green mobility with 300+ fast EV chargers that charge up to 80% in just 30 mins

Arsenal transfer request changes everything as bid rejected amid Mikel Arteta wish

Army Officer Allegedly Attacks SpiceJet Employees over Excess Cabin Baggage in Srinagar (WATCH)

'I lost 16st in a year by doing two things - and neither was a skinny jab'

Antler's sale axes 'biggest carry-on' cabin bags for Jet2 and Ryanair flyers by £75