Reddit can make or break a startup. Many such startups in the US have faced the wrath of Redditors. But the last time this happened to an Indian startup, it was in 2019, when BYJU’S and WhiteHat Jr got flak for misleading ads. That started a period of intense scrutiny for the edtech giant and in some ways, it dented the BYJU’S brand badly.

Six years later, the focus is on Zepto. And another huge Indian brand is facing a bunch of outrage.

The subreddit r/F***Zepto is ground zero when it comes to the anti-Zepto sentiment. Users here outrage about and dunk on the company’s confusing and opaque fee structure. Tired of the so-called dark patterns, close to 30K active users have joined up. And it is not a polite crowd.

Does this subreddit have anything to do with a supposed slowdown in Zepto’s growth and adoption — as per recent reports — or is this just a temporary slow phase in preparation for profitability as the company has claimed?

Let’s try to answer this, but first a look at the key stories from our newsroom this week.

- The Wakefit IPO Question: Experts believe that Wakefit stands out on the back of its mattress business and not the wooden furniture business, which is prone to major headwinds, but it’s the latter that has set the benchmark for revenue growth. So which way will the IPO pendulum swing?

- ClassPlus Caught In Conundrum: Once a pureplay SaaS enabler of teachers, schools, colleges, edtech soonicorn Classplus finds itself at a crossroads as core business growth plateaus. Here’s how the edtech startup flipped its script

- VerSe Hits Reset: After raising more than a billion dollars, digital content aggregator VerSe Innovation fights for relevance as its core businesses face AI disruption at a time when the ad revenue model is shaken. But can AI also save this unicorn?

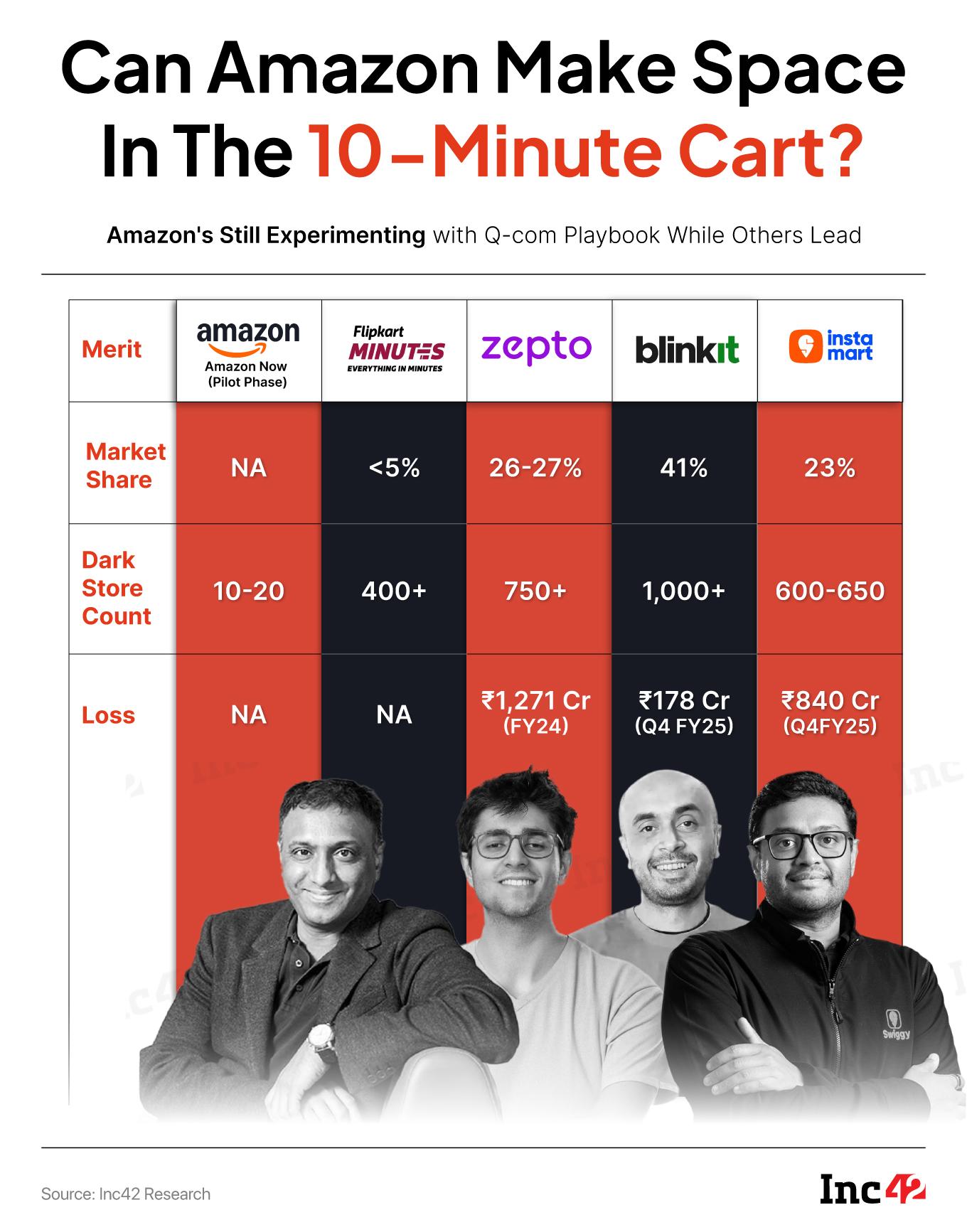

Brokerage and analyst reports in the past two weeks have pointed to Blinkit and Instamart grabbing market share even as investments in dark store expansion and other operational capacity have reduced.

Eternal-owned Blinkit and Instamart gained market share as per a report by ICICI Securities, with the former said to have seen a 25% growth in gross order value, compared to Instamart’s 22% QoQ growth in Q1 FY26. This is against a sector-wide 20% increase in GOV, indicating that the two listed players have managed to capitalise in the past quarter.

The numbers also likely mean that Zepto lost some market share or did not see as much growth as it had enjoyed previously. Notably,Zepto was said to be looking to reduce its cash burn and turn profitable as it gears up for its IPO. This also resulted in the company deferring its public listing plans to 2026 from 2025 earlier.

That’s not to say that things are bad at Zepto. Cofounder and CEO Aadit Palicha said last month that the decision to defer the filing of draft papers was taken asthe company wants to increase domestic ownership. He also claimed that Zepto was close to achieving EBITDA breakeven.

A separate JP Morgan report from April also claimed that Zepto had moderated its growth pace in terms of dark store additions as of March 2025.

While Blinkit and Swiggy’s Instamart added approximately 250-300 dark stores each, Zepto was at less than half of that capacity expansion at 105 stores. The brokerage suggested that growth intensity was waning.

On the positive side, Zepto has more stores that have been operational for longer and therefore this could result in improved margins. With Blinkit and Instamart adding new dark stores, these stores would be a pull on their respective profitability.

Indeed, the aggressive expansion spree undertaken by the three leading players in the quick commerce sector saw their profitability taking a hit over the last few quarters. While the financial numbers for Zepto are not out, Eternal and Swiggy saw their expenses surge over the past few quarters.

While Eternal saw its consolidated net profit crash nearly78% YoY to INR 39 Cr in Q4 FY25, Swiggy’s net loss surged 95% to INR 1,081.2 Cr. This is perhaps why store expansion slowed down in the June quarter compared to the March period.

Or Is It About Profits?In the interim, the companies are now turning their focus towards profitability following the expansion push. ICICI Securities said its channel checks indicate that price discounting steadily decreased across platforms in Q1 and performance marketing spends also remained comparatively muted.

The brokerage expects Blinkit’s GOV to grow 140.3% YoY in Q1, while Instamart is estimated to see a 110.1% increase in GOV. It sees Blinkit posting an adjusted EBITDA loss of INR 150 Cr during the quarter as against anadjusted EBITDA loss of INR 178 Cr in Q4 FY25.

Meanwhile, Instamart is projected to post an adjusted EBITDA loss of INR 910 Cr in Q1 FY26 as against a loss ofINR 840 Cr in Q4 2025.

If indeed Zepto can show all of this is to reach better unit economics in its FY25 numbers, that would add a ton of pressure on Blinkit parent Eternal and Instamart owner Swiggy in the short term.

Both are listed and would therefore need to deliver the value that shareholders are promised. While this might be excused over one or two quarters, there could be more calls for profitable growth if Zepto shows that it can do it.

Especially when we look at the slowdown in food delivery, Zepto has the opportunity to turn what are being seen as cracks into strengths.

Most reports at the beginning of the year indicated that no quick commerce company would be backing off from investing in growth and expansion. Zepto’s plan was to do the same, but as word got around about a public listing, there were doubts about whether Zepto should rein in some of the costs.

Legacy ecommerce players like Amazon, Flipkart, Myntra, and Nykaa are rushing to enter quick commerce, but face challenges like high delivery costs, logistical complexity, and slower execution compared to new-age players. While many don’t directly compete with Zepto, Instamart or Blinkit, there was some fear of a market share battle.

This could have prompted a rethink from growth to profits. Indeed, that was the generally accepted notion when Zepto said it is shifting its IPO timeline.

The public listing, initially planned for 2025, has now been moved to next year, and while Palicha says this is to streamline the cap table and become more domestically-owned, there could be some truth to the story that Zepto has slowed down as these recent reports have indicated.

The next big thing for Zepto would be to release its FY25 financial picture as soon as possible to put to rest any rumours of a slowdown. Blinkit and Instamart’s numbers for the first quarter of FY26 would be out soon, and that could be Zepto’s cue for its own numbers.

Sunday Roundup: Startup Funding, Shutdowns & More- Funding Slips This Week: Between July 7 and 12, startups raised $132.9 Mn across 17 deals, down 58% from the $314.6 Mn secured by 21 startups in the preceding week

- Blip Shuts Down:Just over a year after beginning operations, fashion quick commerce startup Blip has shut shop due to working capital and GTM strategy constraints

- Tesla’s Official Launch: Elon Musk-led Tesla will officially open its first India experience centre in Mumbai on July 15, with deliveries beginning late August

- OYO Gets Relief:In a major reprieve for OYO, the Delhi HC has stayed the recovery of tax demand worth nearly INR 1,140 Cr under the now-revoked angel tax regime

- VSS On AI: Reflecting on India’s position in the global AI race, Paytm founder Vijay Shekhar Sharma has said that the country should position itself as the “AI use case capital” of the world

The post The Zepto Question: Slowing Down Or Just Shoring Up? appeared first on Inc42 Media.

You may also like

Epstein files row: FBI chief Kash Patel breaks silence amid resignation buzz; addresses 'conspiracy theories'

Taarak Mehta Ka's Jethalal is going nowhere; pic of Dilip Joshi with 'bhootni' goes viral

Railways translate 26-year-old dream into reality, Mizoram's Bairabi-Sairang Line ready

PM Modi hails contribution of four nominated to Rajya Sabha

Chhattisgarh: Brother-sister duo among 4 minors drown in pond